Introduction

The year 2024 marks a significant milestone for HELLENiQ ENERGY’s sustainability reporting. The Group published its inaugural Sustainability Statement prepared in compliance with the European Union’s Corporate Sustainability Reporting Directive (CSRD). The Statement aims at enhancing transparency, strengthening communication and providing comprehensive insights to stakeholders regarding sustainability matters. It primarily addresses impacts, risks and opportunities (IRO) that are deemed material, both from an impact materiality and financial materiality perspective, while encompassing additional information to further increase transparency. The Statement includes information regarding strategy, policies, actions, metrics and targets across all material IRO, in accordance with the European Sustainability Reporting Standards (ESRS) under the Environmental, Social and Governance (ESG) pillars.

This section of the Annual Report presents the Group’s performance in terms of environmental, social, and governance (ESG) and the data presented are consolidated at the Group level. A Double Materiality Assessment (DMA) of sustainability impacts, risks, and opportunities (IRO) was conducted, adhering to criteria aligned with the European Sustainability Reporting Standards (ESRS). This assessment encompassed the Group’s entire value chain and was conducted for the financial year 2024, as well as the short term (2025), medium term (2026-2029) and long term (2030-2035) perspective. HELLENiQ ENERGY, considering all the Group’s business activities, associated assets, and business plans, has identified 16 material impacts, risks and opportunities (IRO) across 6 material sustainability areas, which include:

- climate change mitigation and adaptation,

- pollution of atmosphere,

- health, safety and well-being,

- economic impact,

- mobility,

- energy (access and availability).

These IRO primarily relate to environmental and social matters, extending across both present and future timeframes, with their materiality generally increasing over the long-term. There is significant interconnection of those IRO throughout the value chain, predominantly within the organization’s own operations. This interdependency requires the adaptation of strategy and the adoption of a comprehensive approach across multiple dimensions, including the resolution of operational challenges, the enhancement of daily operations, the restructuring of corporate governance, and the improvement of risk management protocols. The outcomes of the DMA have affirmed the necessity to progress and accelerate energy transition as outlined in the Group’s strategic plan, to address the challenges and capitalize on opportunities. The required information pertaining to the governance procedures, strategic frameworks, management approaches, Key Performance Indicators (KPIs) and targets is comprehensively presented.

Indicatively, this section includes information and data related to:

- The total GHG emissions and the Group’s plans towards climate change mitigation along with a climate scenarios assessment of the Group’s assets in the framework of climate change adaptation management approach.

- Air emissions, water effluents and wastes, and circular economy.

- Health and safety KPIs and targets, as well as own workforce metrics.

- The direct, indirect and induced positive impact and footprint on the Greek economy through the interaction with suppliers, customers, consumers and affected communities, including the number of beneficiaries from corporate responsibility initiatives.

- The Group’s active engagement with consumers and end-users towards enhancement of their access to conventional and sustainable energy products and mobility services.

In addition, disclosures related to Article 8 of the EU Taxonomy Regulation regarding the “eligible” activities for the Taxonomy and the environmentally sustainable “Taxonomy aligned” activities of the Group are included.

HELLENiQ ENERGY is committed to further enhancing the completeness and comprehension of the environmental, social and governance matters considered material from both an impact and financial materiality perspective. This shall serve as an ongoing effort to inform decision-making processes, refine strategic approaches and contribute to sustainability.

Sustainability Policy

HELLENiQ ENERGY and its subsidiaries align their business activities towards the achievement of the United Nations’ Sustainable Development Goals and the European Green Deal. The core of our strategy addresses the major issues of sustainable energy for all and climate neutrality, as well as the adoption of corporate governance principles that ensure, as a priority, the safe and without accidents, financially sustainable operation, while respecting the Environment and Society. The Sustainability Policy is available on the HELLENiQ ENERGY website.

Business Model

HELLENiQ ENERGY is a leading energy company in Southeastern Europe, engaged in various sectors including refining, petrochemicals, fuels marketing, renewable energy, power and gas, electromobility and hydrocarbon exploration. The Group’s business model, which includes value creation, operational activities and the most important results, is presented in the graph below:

ESG Goals

HELLENiQ ENERGY participates in the energy transition, fostering innovation and developing low-carbon solutions, thus promoting sustainability. The table below presents the Group’s Goals and highlights the contribution of various services to the defined ESG Goals.

Additionally, the Group has incorporated the United Nations Sustainable Development Goals (SDGs) into its strategy and is actively engaged in efforts to attain these objectives through targeted policies, initiatives, and social programs.

Based on the results of the DMA, the Group has aligned its strategy with the Goals as follows:

ESG Standards, Frameworks and Ratings

Stakeholders and Double Materiality Assessment

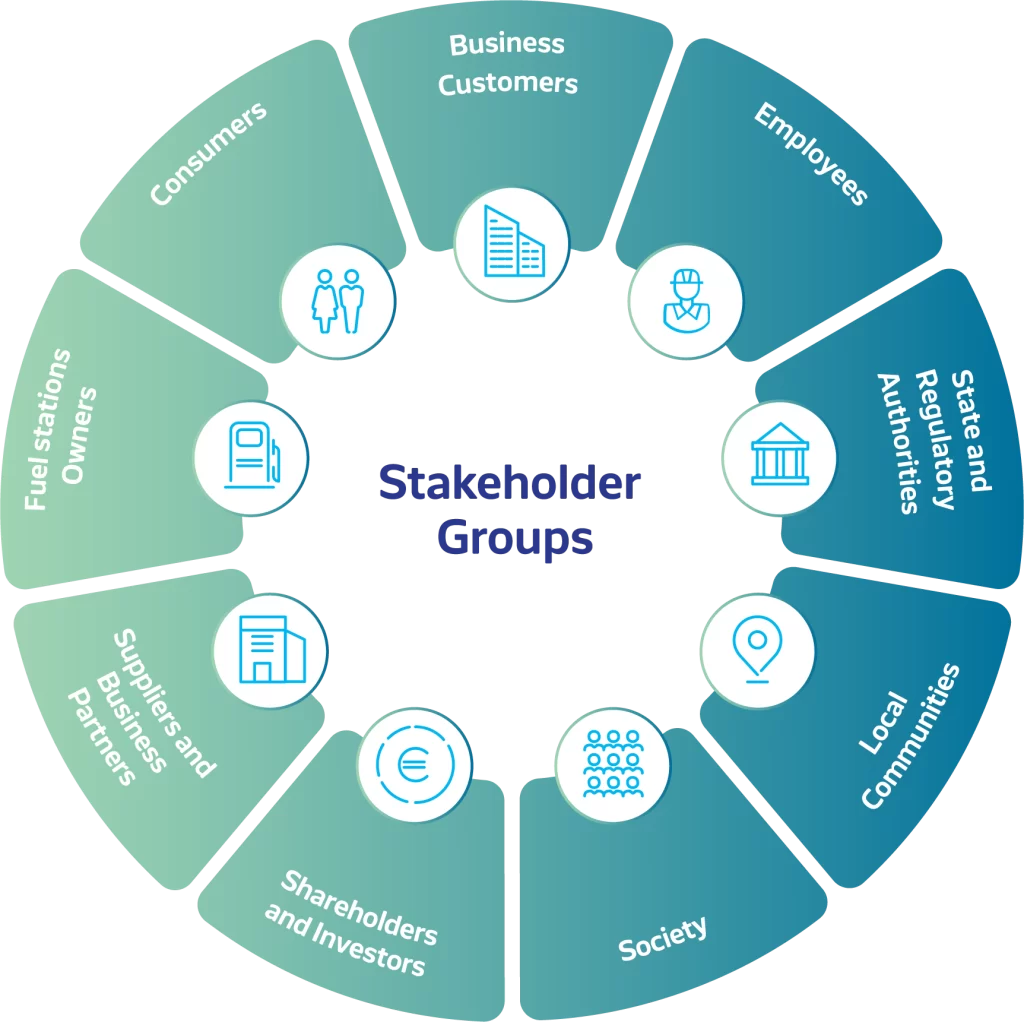

Stakeholders are defined as entities or individuals who may be significantly impacted by the Group’s activities or who may influence the Group’s ability to implement its business strategy and achieve its objectives. Engagement with stakeholders constitutes an integral component of the Group’s due diligence process, as well as the assessment of material impacts, risks and opportunities pertaining to sustainability matters. Engagement is conducted throughout the year by employing various channels, facilitating bilateral communication that informs the Group’s decision-making process. The identified stakeholder groups of HELLENiQ ENERGY are presented below.

In the context of consulting with stakeholders and analyzing the impacts of the Group’s activities, a Double Materiality Assessment of sustainability (DMA) impacts, risks and opportunities (IRO) was conducted based on a defined set of selection criteria and aligned with the guidelines of the European Sustainability Reporting Standards (ESRS). These criteria encompassed factors such as stakeholders’ participation rate, impacts, risks and opportunities, sales volume, number of employees across geographies / value chain and dependencies on ecosystems, energy, fuel, and marine resources, as well as dependencies related to people. As part of the DMA, key stakeholders are involved in the process through targeted discussions on sustainability matters.

A total of 71 IROs were identified and evaluated as part of the DMA. Of these, 16 were deemed material across 6 sustainability matters. Specifically, with regard to Impact Materiality, 24 impacts (I) were assessed, of which 8 were deemed to be material. In terms of Financial Materiality, 47 risks and opportunities (R/O) were assessed, of which 8 were deemed material.

Environment

Climate Change

The Group climate change strategy is based on the implementation of the transition plan “Vision 2025” that was driven by rapid changes in the energy environment. HELLENiQ ENERGY focuses on increasing its value through modernization of existing activities and its expansion into cleaner forms of energy, including Renewable Energy Sources (RES). The Group has set targets that are fully aligned with United Nations’ Sustainable Development Goals and the European Green Deal, focusing on reducing the carbon footprint and aiming for climate neutrality by 2050.

More specifically, by 2030 it has set the following goals compared to 2019:

- Reducing Scope 1 and 2 emissions (market-based) by more than 30% through energy use optimization and the application of innovative GHG (Greenhouse Gas) emission reduction technologies in refining activities.

- Further developing and implementing RES investments (with a total capacity of over 2 GW, including an intermediate goal of 1 GW by 2026) to contribute to an additional avoidance of >20% of CO2 emissions.

The Group designated 2019 as the baseline year for GHG emissions, due to its status as a representative year for the Group’s operations and emissions profile prior to the implementation of substantial decarbonization initiatives. This particular year encapsulates the Group’s pre-transition emissions levels, thereby providing a definitive and consistent benchmark for monitoring progress.

The Group’s strategic approach emphasizes critical matters, including the provision of sustainable energy for all and the attainment of climate neutrality. Additionally, it advocates the implementation of corporate governance principles that prioritize operations characterized by safety and the absence of accidents, financial sustainability, and a profound respect for the environment and society. The Group conducts rigorous assessments of its transition plan to ascertain its alignment with the national climate law, the national energy and climate plan, and the national long-term strategy, thereby ensuring that its objectives consistently remain compatible with these overarching goals.

HELLENiQ ENERGY, through continuous monitoring of developments, significantly contributes to the promotion and facilitation of sustainable mobility, supporting initiatives designed to alter the technological framework and fuel composition of transportation vehicles, thereby advancing the transition towards a low- carbon economy.

HELLENiQ ENERGY has prioritized its energy transformation, with the objective of reducing its carbon footprint. In this regard, concerning its principal activities, it plans investments in energy savings and efficiency, the production of low-carbon fuels, such as blue and green hydrogen, biofuel production facilities, and carbon capture technologies. At the same time, it is investing in the development of a new business pillar in RES, including energy storage projects, thereby developing a diversified portfolio with geographical dispersion, as well as a balanced mix among various technologies.

As part of the progress in implementing the strategic plan, several projects are currently progressing. Furthermore, milestones achieved during the reporting period include the integration of new approval flow streams into Governance Structures for the approval of various initiatives, the implementation of processes for monitoring targets by executives, and significant progress within a short timeframe regarding the installed renewable energy capacity.

In addition, important milestones were achieved, with outcomes validating preliminary strategic decisions:

- Tangible measures were implemented across refineries in alignment with HELLENiQ ENERGY’s established objectives;

- Operational excellence in refining processes, supported by digital transformation;

- 0.5 GW of RES in operation, with an additional 5.2 GW of RES projects under development.

In the renewable energy sector, the development strategy integrates the maturity of a diversified portfolio of projects, encompassing PV, wind, and biomass, alongside targeted acquisitions of matured or operating projects, primarily PV parks, wind farms and energy storage systems, such as Battery Energy Storage Systems (BESS) and pumped hydro storage.

Moreover, significant factors contributing to the escalating carbon costs include European legislation (‘Fit for 55’), such as the European Trading System (EU ETS) and the Carbon Border Adjustment Mechanism (CBAM). This is particularly relevant given the potential inclusion of refineries within the CBAM framework commencing in 2026. In 2024, the financial implications for HELLENiQ ENERGY were intricately linked to the increasing costs associated with addressing the emission allowance deficit, as all three of the Group’s refineries in Greece are active participants in the EU ETS.

During the period 2021-2025 (the first sub-period of the 4th trading phase) and under the new free allocation rules, compliance costs have escalated substantially due to the sharp increase in allowance prices (€73.5/ton CO2 at the end of 2024) in contrast to the end of the preceding phase (approx. €32/ton CO2), coupled with the reduced allocation of free allowances under the current rules.

A further increase in compliance costs and a heightened risk of carbon leakage are anticipated, given the proposed modifications to the EU ETS as part of the implementation of the European Green Deal and the European reduction targets under the ‘Fit for 55’ package. The Scope 1 CO2 emissions from the three refineries for the year 2024 amount to 3.9 million tons, representing over 99% of the Group’s aggregate Scope 1 emissions (direct emissions).

AIC – Aspropyrgos Industrial Complex

EIC – Elefsina Industrial Complex

TIC – Thessaloniki Industrial Complex

Indirect Scope 2 market-based emissions for the year 2024 amounted to 261,044 tn CO2e, while Scope 2 location-based emissions for the same year came in at 334,732 tn CO2e. Other indirect Scope 3 emissions were calculated at 51,411,449 tn CO2e (the categories are presented in detail in the Sustainability Statement of the 2024 Annual Financial Report). The Group’s total carbon footprint amounted to 55,649,046 tn CO2e (market-based) and 55,722,734 tn CO2e (location- based).

The refining sector is among those industries susceptible to carbon leakage, which may result in a significant deterioration in its competitive edge relative to analogous facilities situated outside Europe. Owing to its geographical positioning at the borders of the EU, the Group encounters an elevated competitive threat compared to other European countries. This heightened threat arises from adjacent countries that are not participants in the ETS and produce identical products, yet do not incorporate carbon costs into their operational expenses, costs which the Group must bear due to its participation in the EU ETS.

In 2024, HELLENiQ ENERGY conducted for the first time a climate scenario analysis in accordance with the requirements of the TCFD, which has been incorporated into the IFRS framework under the International Sustainability Standards Board (ISSB), for all Group activities. By modelling different climate scenarios, the Group assessed physical and transition risks in the short, medium and long-term timeframes, as presented below:

- Short-term time horizon: 2025

- Medium-term time horizon: 2026 – 2029

- Long-term time horizon: 2030 – 2050

Specifically, the Group carried out a climate scenario analysis focused on the development of two scenarios: the Net Zero Transition Scenario (limiting global warming to well below 2°C, preferably 1.5°C) and the High Emissions Scenario (warming over 3°C). The physical risks identified as high risk include heatwaves in the long-term time horizon and wildfire across all time horizons. The high-risk transition risks identified in the long-term time horizon include the transition to a low carbon economy and emerging regulation (carbon pricing mechanisms).

HELLENiQ ENERGY has also recognized several opportunities in emerging low-carbon technologies developed to address climate change, such as blue and green hydrogen generation technologies, CO2 capture and storage technologies, as well as other solutions aimed at replacing fossil fuels with lower-carbon alternatives. As part of the strategy, these technologies are systematically assessed for their potential applications and effectiveness in mitigating risks and maximizing benefits.

Air Emissions

Air emissions originating from the operation of all industrial facilities within the organization’s operations are rigorously monitored in accordance with the specific terms of the environmental permit issued for each facility, thereby ensuring strict compliance with the statutory emission limits, and substantially contributing to the improvement of air quality. Moreover, a substantial proportion of these industrial facilities are equipped with continuous emission monitoring systems. The data generated by these systems are thoroughly analyzed, and the results are subsequently submitted to the environmental authorities for purposes of monitoring and control.

The Group’s strategy is predicated upon the implementation of environmental investments aimed at improving air quality. For example, in the case of particulate matter and with the aim of achieving further emission reductions, an electrostatic precipitator (ESP) filter was installed at the Aspropyrgos refinery’s catalytic cracking unit stack. This abatement technique became fully operational in 2022 and has since contributed significantly to reducing the relevant particulate matter emissions of the unit by more than 80%. Furthermore, continuous improvement is achieved through measures such as maximizing the use of fuel gases, employing fuels with higher environmental standards, investing in advanced production technologies (e.g. low nitrogen oxide burners) and directly reducing emissions through VOC recovery systems during the loading of petroleum products.

At present, the Group has not undertaken any supplementary initiatives, as there exists no specific pollution objective. The environmental impact realized thus far is considered particularly favorable, as evidenced by the substantial reduction in key air quality metrics in recent years. This is further corroborated by the corresponding decrease in quantitative air quality monitoring data from the surrounding areas.

*the PM indicator is multiplied by 10 in order to enhance its visual presentation

In 2024, the decreasing trend of SOx, NOx, VOC and PMs emissions indexes of the last 5 years continued, up to 43% (SOx emissions).

Circular Economy

HELLENiQ ENERGY is committed to the protection of the environment and the sustainable and rational use of natural resources. To this end, it undertakes all necessary measures and actions to prevent and mitigate potential impacts, while promoting initiatives that support the preservation of natural capital. The efficient utilization of materials and natural resources throughout their life cycle constitutes an important business opportunity and reflects the Group’s commitment to environmental protection.

Modern wastewater treatment facilities, such as the Group’s three-stage integrated wastewater treatment plants at the refineries, ensure the protection of water bodies through the continuous improvement in wastewater management performance. In this context, the project of upgrading the Wastewater Treatment Plant of the Aspropyrgos refinery progressed according to the relevant plan and is expected to be fully operational by 2025. These advanced treatment facilities ensure that water used in operations is effectively treated and reused where possible, minimizing environmental impact and promoting conservation. By integrating such wastewater treatment systems, the Group demonstrates its dedication to preserving water resources, reducing pollution, and maintaining sustainable practices across its value chain.

In 2024, the water recycled and reused in production facilities amounted to 17%. Moreover, the total water discharges amounted to 7,229,408 m³, of which over 96% is discharged in the sea after treatment.

In addition to wastewater management, the Group invests in the sustainable management of waste, seeking maximum possible recycling for different waste streams and subsequently following best practices with on-site management of other waste streams, with a focus on protecting the environment and human health.

HELLENiQ ENERGY’s strategic approach is based not only on the reduction of waste to landfill through investments in modern waste treatment facilities, but also on the creation of synergies for the utilization of waste for energy recovery and the exploration of alternative technologies for its use as raw materials, with the aim of substituting mineral raw materials.

It is emphasized that the continuous reduction of the quantity of waste for final disposal significantly contributes not only to minimizing the negative impact on the environment and human health but also to reducing the operating costs of business activities.

Petroleum by-products of the refinery processes are classified as waste (self-produced or third-party) at the stage of their life cycle and constitute a significant opportunity to be used as raw materials in the Group’s production facilities or as fuels, in accordance with the principles of a circular economy.

The Group’s objective is to maintain the percentage of waste sent to disposal (landfill/ incineration) at 15% or less by 2030. It is noteworthy that this target is not mandated by legislation, highlighting the Group’s proactive commitment to sustainability. By voluntarily setting this target, the Group demonstrates its recognition of the critical role that sustainable waste management plays in environmental stewardship and corporate responsibility.

In 2024, there was an increase of 22% in the amount of waste generated compared to the previous year, which was accompanied by a high recovery rate as a result of the adoption of improved recycling and recovery practices at the Group’s facilities. More than 26,898 tons of waste, representing over 88% of the total, was either reused, recycled, or further recovered through a raw material recovery process.

It is noted that the quantities of solid waste per industrial facility depend, for the most part, on the cleaning of product tanks and, therefore, vary from year to year, depending on tank maintenance scheduling and, secondarily, on the availability of solid waste treatment plants, either on-site or off-site.

EU Taxonomy

EU Taxonomy Overview

The ‘Fit for 55’ package aims to translate the ambitions of the Green Deal into a legal obligation, according to which the EU member states commit to reduce the net greenhouse gas (GHG) emissions by at least 55% by 2030, compared to 1990 levels. In order to meet the emission targets and other environmental objectives, the EU, through the ‘Taxonomy Regulation’ (Regulation (EU) 2020/852) established the framework for the creation of the EU Taxonomy of environmentally sustainable economic activities. The EU Taxonomy serves as common classification system to define the environmental performance of economic activities across a wide range of industries, helping investors, companies and financing providers transition to a low-carbon, resilient and resource- efficient economy.

The Taxonomy Regulation includes a hierarchy of two levels of reporting, Taxonomy-eligibility and Taxonomy-alignment, with the latter as subset of the former.

An economic activity is considered Taxonomy-eligible if it is listed in the EU taxonomy and can potentially contribute to realizing at least one of the following six environmental objectives:

- Climate change mitigation (CCM)

- Climate change adaptation (CCA)

- Sustainable use and protection of water and marine resources (WTR)

- Transition to a circular economy (CE)

- Pollution prevention and control (PPC)

- Protection and restoration of biodiversity and ecosystems (BIO)

In December 2019, the European Union (EU) presented the European Green Deal which adopts a set of initiatives covering the climate, environment, energy, transport, industry, agriculture and sustainable finance, with the aim of achieving climate neutrality by 2050.

Environmental objectives for Taxonomy Eligibility

An economic activity is defined as environmentally sustainable i.e. Taxonomy-aligned if it meets all three of the following conditions:

EU Taxonomy Reporting* by HELLENiQ ENERGY Group

HELLENiQ ENERGY Group (the «Group») has published the Taxonomy Report for the year 2024 in accordance with the Taxonomy regulation. This report is included as part of the Sustainability Report, which constitutes a section of the Annual Financial Report.

The reported KPIs pertain to the consolidated entities included in HELLENiQ ENERGY Group’s financial statements. Economic activities of joint ventures and associates where the Group does not have management control, are not included in this disclosure.

Process Analysis of the Group’s Business Activities

*The HELLENiQ ENERGY Group’s EU Taxonomy Report is presented in detail in the 2024 Annual Financial Report.

1. Eligibility Screening

The assessment of the eligibility of the Group’s business activities was carried out based on the EU Taxonomy Regulation, while with regard to the identification of eligible activities related to all six environmental objectives, the nature of the Group’s business activities and the relevant NACE codes were thoroughly analyzed and assessed.

Eligible Activities

These 14 EU Taxonomy-defined economic activities include:

| EU Taxonomy-defined Economic Activity | Description of the Group's Activity | Environmental Objective |

|---|---|---|

| Petrochemicals | ||

| 1) CCM 3.14 Manufacture of organic basic chemicals | Production of propylene | Climate Change Mitigation (CCM) |

| 2) CCM 3.17 Manufacture of plastics in primary form | Production of polypropylene | Climate Change Mitigation (CCM) |

| 3) CE 1.1 Manufacture of plastic packaging goods | Production of Biaxially Oriented Polypropylene (BOPP) films | Circular Economy (CE) |

| Renewable Energy Sources | ||

| 4) CCM 4.1 Electricity generation using solar photovoltaic technology | Construction and operation of large-scale electricity production facilities from solar energy using PV systems | Climate Change Mitigation (CCM) |

| 5) CCM 4.3 Electricity generation from wind power | Construction and operation of large-scale electricity production facilities from wind energy | Climate Change Mitigation (CCM) |

| 6) CCM 4.9 Transmission and distribution of electricity | Construction of a high-voltage 150 kV electricity transmission line connecting the Group’s PV projects to potential consumers | Climate Change Mitigation (CCM) |

| 7) CCM 4.10 Storage of electricity | Construction of battery energy storage systems and pumped hydropower storage facilities to store electricity | Climate Change Mitigation (CCM) |

| Refining, Supply & Trading | ||

| 8) CCM 6.10 Sea and coastal freight water transport, vessels for port operations and auxiliary activities | Marine and ship transport services of bulk liquids or gases by tankers | Climate Change Mitigation (CCM) |

| Electromobility Services | ||

| 9) CCM 6.15 Infrastructure enabling low-carbon road transport and public transport | Construction and operation of EV charging stations | Climate Change Mitigation (CCM) |

| Other Activities | ||

| 10) CCM 7.6 Installation, maintenance and repair of renewable energy technologies | Small-scale PV systems installed on-site as technical buildings systems in several Group’s facilities e.g., rooftop PV systems | Climate Change Mitigation (CCM) |

| 11) CCM 7.7 Acquisition and ownership of buildings | Ownership of buildings or properties | Climate Change Mitigation (CCM) |

| 12) CCM 8.1 Data processing, hosting and related activities | Operation of data centres | Climate Change Mitigation (CCM) |

| 13) CCM 8.2 Data-driven solutions for GHG emissions reductions | The use of energy modeling, optimization, and real-time data analytics solutions that enable GHG emissions reductions by evaluating energy performance, providing actionable insights, and consolidating data from various systems | Climate Change Mitigation (CCM) |

| 14) CE 4.1 Provision of IT/OT data-driven solutions | Deployment of advanced asset performance management solutions that enable real-time monitoring, data collection, and analysis of asset health and performance. These tools leverage AI-driven analytics to identify inefficiencies, predict potential failures, and provide early warnings to optimize maintenance activities and improve operational efficiency | Circular Economy (CE) |

Non-Eligible Activities

The rest of the Group activities have not been considered eligible as they are not currently considered in the Climate Delegated Act, Complementary Climate Delegated Act, or Environmental Delegated Act. These include activities in Refining, Supply & Trading, Petrochemicals, Fuels Marketing, Power Generation & Natural Gas, Exploration & Production, and other supporting activities (non-revenue generating activities). For greater details on the Group business activities, please to the section “Business Activities” of “Business Review” chapter.

2. Alignment Screening – Substantial Contribution Criteria

Next, each of the eligible activities (from the Group’s own operations) identified in the previous phase, were analyzed against the corresponding substantial contribution criteria (SCC) for CCM and CE objectives, as outlined in the Climate Delegated Act, the Environmental Delegated Act and any relevant amendments.

In summary, of the 104 eligible activities (from the Group’s own operations) corresponding to 14 EU Taxonomy-defined activities, eighty-three (83) Group’s activities were found to meet the respective SCC for CCM objective (corresponding to eight (8) EU Taxonomy-defined activities), while one (1) Group’s activity met the SCC for the CE objective (corresponding to one (1) EU Taxonomy-defined activity).

3. Alignment Screening – Do No Significant Harm (DNSH) Criteria

For eligible activities that meet their respective SCC as identified in the previous phase, the Group has applied the guidance established in Article 17 of the Taxonomy Regulation and Climate Delegated Act and Environmental Delegated Act to assess them against the relevant DNSH criteria. The analysis of the specific DNSH criteria against the relevant activities assessment is available in the 2024 Annual Financial Report.

4. Alignment Screening – Minimum Social Safeguards

To ensure compliance with Article 18(1) of the Taxonomy Regulation, the Platform for Sustainable Finance, through its report on minimum safeguards, suggests a two-pronged approach consisting of two criteria.

The main analyses employed to assess whether the minimum safeguards are met are described below.

5. Calculation of Financial Key Performance Indicators (KPIs)

The Disclosures Delegated Act, as outlined in Annex I (KPIs of non-financial undertakings), specifies three KPIs to be disclosed concerning the proportion of the Group’s Taxonomy-eligible and Taxonomy-aligned activities. Specifically, these KPIs include Turnover, Operating Expenses (OpEx) and Capital Expenditure (CapEx). The methodology for calculating the aforementioned Key Performance Indicators (KPIs) can be accessed in the 2024 Annual Financial Report.

Overall Results of EU Taxonomy-Compliance Assessment

Following the completion of eligibility and alignment screening for all the Group’s activities, as extensively discussed in the “Process for Analyzing the Group’s Business Activities” section in the 2024 Annual Financial Report, a summary of the results is presented herein.

We aim to signigicantly reduce our carbon footprint, with the objective of achieving net-zero by 2050.

Overall Results of KPIs

More disclosures of the three KPIs are provided below

Detailed tables delineating the proportion of products or services associated with Taxonomy-aligned economic activities across the three KPIs are available in the 2024 Annual Financial Report.

Own Workforce

HELLENiQ ENERGY’s strategy and business model unequivocally demonstrate its steadfast commitment to safeguarding its employees by proactively addressing both actual and potential impacts. This commitment to maintaining a safe and healthy work environment is substantiated by the achievement of zero significant industrial accidents, the implementation of a robust Health and Safety Management System and the provision of employee benefits such as insurance, financial aid and training programs.

HELLENiQ ENERGY has established specific procedures governing its partnerships, ensuring that these third-party entities adhere to labor legislation (national, European, ILO) regarding human rights and working conditions. Through its Sustainability Policy, HELLENiQ ENERGY and its subsidiaries are committed to promoting human rights, respecting diversity and equality, and eliminating all forms of discrimination, throughout the value chain, encompassing local communities, consumers, and partners. The cooperation framework includes the Code of Conduct, the Procurement Regulations, the Sustainability Policy and procedures for promoting health and safety, commitment to environmental standards, responsible labor practices, and respect for human rights, as well as the evaluation process.

All executives, members of the management, employees, contractors and individuals providing services to HELLENiQ ENERGY and its Group companies are obligated to comply with the Sustainability Policy and uphold Health, Safety, Environment and Sustainability requirements. The health and safety of personnel are fundamental values, primary concerns, and essential conditions for the conduct of the Group’s activities.

The Policy and the System are in compliance with relevant Greek and European legislation, as well as other internationally recognized codes and practices associated with these matters, and, in many instances, are even more stringent.

HELLENiQ ENERGY acknowledges that its workforce is inextricably linked to the development and improvement of its performance in all areas of business activity. As a result, the company prioritizes employability by both retaining existing jobs and creating new ones. Guided by the values of meritocracy, excellence, integrity, stability, consistency, innovation, continuous learning, and adaptability, HELLENiQ ENERGY has successfully cultivated a modern working environment.

| Gender | Number of employees (head count) |

|---|---|

| Male | 2,965 |

| Female | 769 |

| Total Employees | 3,734 |

The Group maintains five (5) collective bargaining agreements (HELPE, EKO, DIAXON, ASPROFOS, EKO CYPRUS), encompassing over 80% of its workforce under these agreements. Moreover, all employees, irrespective of gender, are entitled to avail themselves of family-related leave.

The performance of the Group’s employees undergoes an annual evaluation. Every employee participates in a yearly procedure designed to assess their performance, through which a plan is formulated to enhance their knowledge and develop their skills.

For senior and top managers, the assessment is conducted annually based on KPIs, aligning the company’s performance with the managers’ targets, covering areas such as sustainable development, safety, environment and other related matters.

Furthermore, the Group ensures equitable training opportunities for all employees according to their specialty. Nonetheless, in industrial facilities, where a higher proportion of males are employed, the average training hours are slightly greater due to the nature of the work and its associated requirements, resulting in an increased average number of training hours for male employees.

| Gender | % of employees who participated in regular performance and career development reviews |

|---|---|

| Male | 98 |

| Female | 93 |

| Gender | Average number of training hours per employee |

|---|---|

| Male | 43.6 |

| Female | 29.4 |

HELLENiQ ENERGY is committed to maintaining a transparent and equitable remuneration framework through its operations. The average annual total remuneration ratio within the Group stands at 28.41, indicative of an approach to compensation that is harmonized with performance, responsibilities, and prevailing market standards. This ratio underscores the Group’s dedication to fostering a fair and competitive work environment, in strict accordance with its fundamental principles of equality and compliance with Greek, national and EU regulations.

Health & Safety

For the HELLENiQ ENERGY Group, Health and Safety constitute paramount priorities in all its activities. The Group adopts a comprehensive approach to managing Health and Safety matters, which entails planned initiatives and preventive measures aimed at eliminating risks and enhancing performance. Simultaneously, this approach encompasses the implementation of management systems, inspections, and measures to reinforce leadership across all activities of the Group. Furthermore, the Group ensures the implementation of necessary safety precautions for its employees, external partners, and visitors in all work areas, aligning with the United Nations’ international Sustainability Goal for Good Health (SDG 3). The Group consistently invests in preventive measures, infrastructure, and enhancements, reviewing procedures and aligning them with current standards and best practices. Additionally, the Group places significant emphasis on training its personnel and partners in the field of Health and Safety to ensure compliance with the most rigorous criteria at both national and European levels. In 2024, over €22 million were allocated to safety improvements across all Group facilities in Greece and internationally, in addition to actions undertaken as part of project upgrades and the modernization of equipment and units.

All facilities within the Group establish objectives to monitor and enhance their performance in relation to health and safety matters, with periodic reports being assessed against these objectives. Targets pertaining to specific indicators of health and safety are established and monitored in accordance with the recommendations put forth by CONCAWE.

Health and Safety (H&S) Indicators

In 2024 the Lost Workday Injury Frequency (LWIF) and All Injury Frequency (AIF) indicators – which are key safety indicators – exhibited a decrease of 34.1% and 18.8% respectively, in comparison to the preceding year. This reduction stands in stark contrast to the corresponding European indicators, which, based on the most recent data available up to 2023, exhibited an increase. Furthermore, the Process Safety Event Rate (PSER) indicator, regarded as the principal measure of process safety, also experienced a reduction of 46.9% relative to the previous year.

This trend aligns with the corresponding European indicator, which observed a marginal decrease.

In the year 2024, a total of over 16 million working hours were recorded, during which 19 Lost Workdays Injuries were documented among both employees and external collaborators.

The graphs below indicate the trends in the principal safety key performance indicators (KPIs)*.

*CONCAWE data for 2024, will be available in July 2025

12 Lost workday injury frequency (LWIF): (LWIs)/ 1 million manhours

13 All injury frequency (AIF): Sum of Fatalities + LWI + Restricted Workday Injury + Medical Treatment Case/1 million manhours

14 Process Safety Event Rate (PSER): Number of Process Safety Events/1 million manhours

Leading Health & Safety KPIs

The target for reporting and investigating near misses was successfully attained in 2024, serving as a crucial leading indicator for health and safety (H&S) performance across all facilities within the Group.

As part of the efforts to establish a unified Safety Culture at all Group facilities, ongoing training in fundamental H&S practices was provided.

This training encompassed areas such as fire safety, first aid, rescue techniques, basic safety procedures, best practices, etc. Moreover, this training was extended to external partners, contractors, visitors, tank truck drivers, and fuel station operators, who were enrolled in accredited training centers.

Affected Communities

HELLENiQ ENERGY significantly contributes to the Greek economy through its engagements with suppliers, customers, consumers, affected communities, and the Greek State. The contributions of HELLENiQ ENERGY extend beyond the creation of direct added value, encompassing indirect support for the development of the Greek economy through its commercial transactions with domestic suppliers of products and services. In addition, the Group’s activities create induced effects, directly and indirectly, such as the expenditure of employees’ incomes. Moreover, HELLENiQ ENERGY bolsters the fuel retail sector, being one of the primary suppliers of liquid fuels within Greece.

The proportion of supplies from local communities stands at 10.1% for HELLENiQ PETROLEUM S.A., DIAXON (industrial companies) and KOZILIO 1 (Kozani PV park). In contrast, for other entities within the Group, procurements from local suppliers constitute 92.2% of the total value of purchases.

It should be noted that the aforementioned percentages exclude expenditures such as those related to procurement, transportation and storage of raw materials and intermediate products, as well as costs associated with water, energy and telephone expenses, intra-group transactions and payments to public authorities and insurance companies. The Group offers direct employment within local communities, offering 652 positions in the regions of Thriasio, Western Thessaloniki and Kozani.

Corporate Responsibility Program

HELLENiQ ENERGY Group, as a conscientious and socially responsible entity, consistently provides substantial support to both the regions in proximity to its facilities and the entirety of Greece, wherever a genuine need is identified. With a primary focus on individuals and a dedicated commitment to the environment and the mitigation of climate change, the Group addresses the fundamental societal requirements by implementing a comprehensive and diverse Corporate Responsibility action plan.

In the context of promoting social well-being and exerting a positive impact on society, HELLENiQ ENERGY has consistently upheld its vision through various actions, activities, and initiatives aimed at contributing to the community. HELLENiQ ENERGY strengthens community trust through initiatives aimed at improving the quality of life for vulnerable social groups, advancing education, supporting sports, providing relief to communities in emergency situations, enhancing public health, and protecting the environment.

Furthermore, HELLENiQ ENERGY is dedicated to fostering a supportive and inclusive workplace culture by actively engaging employees and empowering them to serve as ambassadors of its Corporate Social Responsibility (CSR) programs. Additionally, the Group utilizes sponsorships in the marketplace to strengthen consumer trust, acknowledging that its stakeholders play an essential role in fostering social change and amplifying the effectiveness of the Group’s initiatives.

Each area of interest is designed through a detailed process involving stakeholders, public opinion surveys, assessments of material impacts, public deliberations, and other consultations.

The Group has designed and implements an extensive and multifaceted Corporate Responsibility program that emphasizes the welfare of individuals and the meticulous stewardship of the environment, while addressing the mitigation of the adverse effects associated with climate change.

2024 Corporate Responsibility Initiatives

Overview of the Corporate Responsibility Program per Area of Impact

Improvement of living conditions

The Group is dedicated to supporting vulnerable social groups and promoting social welfare through initiatives designed to enhance the quality of life for individuals by addressing their fundamental social needs and providing assistance during emergency situations.

Access to food

Provision of support to vulnerable social groups through initiatives and activities that enhance quality of life and promote social cohesion constitutes a fundamental element of HELLENiQ ENERGY’s corporate philosophy. Since 2012, HELLENiQ ENERGY has donated more than 900 tons of food to vulnerable social groups as part of its Social Groceries and Soup Kitchens Support Program in adjacent municipalities. Specifically, in 2024, it donated approximately 105 tons of food and essential goods to support institutions and food establishments in Thriasio Pedio, West Thessaloniki and Kozani.

Contribution to Education

Postgraduate scholarships and rewards program

In 2024, the Group awarded 25 scholarships to outstanding senior students and graduates who are pursuing postgraduate studies at prestigious Greek and international universities through the Postgraduate Scholarships program. Moreover, in 2024, EKO Cyprus, a subsidiary of the Group, introduced the Postgraduate Scholarships program. This initiative represents one of the most substantial private sector scholarship programs, aimed at recognizing and supporting young individuals who demonstrate outstanding academic performance, thereby facilitating their professional development. Between 2013 and 2024, the Company has awarded more than 300 scholarships through this program.

The Company has consistently and substantially sup-ported the efforts of the younger generation to acquire knowledge and evolve, acknowledging and rewarding excellence in practice. Furthermore, HELLENiQ ENERGY devises and implements initiatives that enrich the educational experience.

In 2024, HELLENiQ ENERGY had the privilege of presenting awards for the 16th consecutive year to high-school graduates from the neighboring municipalities of Thriasio Pedio, West Thessaloniki and Kozani, in recognition of their excellent academic performance. Specifically, in 2024, the Group awarded cash prizes to a total of 295 exceptional high-school graduates, thereby supporting them as they embark on their university studies. Additionally, emergency assistance was provided to 429 outstanding graduates from the Thessaly region, which had been adversely affected by the floods of September 2023. Since 2009, the Group has acknowledged a total of 5,340 exceptional graduates from General and Vocational Senior High Schools.

“Earth 2030” Educational Suitcase Program

The Group, in collaboration with the Civil Non-Profit Company “Agoni Grammi Gonimi”, is implementing the “Earth 2030” Educational Suitcase program. This educational initiative is directed towards elementary and middle-school students, with the aim of enhancing their understanding of the United Nations Sustainable Development Goals. The primary objective of this action is to educate and raise awareness among young students and teenagers regarding the 17 UN Goals, while also cultivating ambassadors who will effectively communicate these Goals to the broader public. In 2024, the program reached 10,000 students from 47 schools and 10 camps across Greece.

Actions to Mitigate Climate Change Impacts

The Group prioritizes the mitigation of climate change effects as a key element of its Corporate Responsibility framework. To achieve this objective, the Group undertakes various initiatives to foster environmental awareness and enhance stakeholder understanding of climate change impacts. The Group consistently employs state-of-the-art methodologies in managing its operations across all facilities and actively participates in collaborative research and projects with academic institutions to minimize its environmental impact and conserve energy resources.

Implementation of anti-erosion projects in fire-affected areas

For the fourth consecutive year, HELLENiQ ENERGY collaborated with the authorities to restore forest areas affected by fires, aiming to reduce soil erosion and aid its natural recovery. In February 2024, erosion-control measures were completed in West Attica’s forested regions, covering 620 hectares impacted by the wildfires of July 2023. These ecological interventions used construction materials sourced exclusively from burnt trees in the area. Specifically, approximately 201,000 meters of log bundles, log grids, branch bundles, and 283.5 square meters of log barriers were installed to support soil retention and foster forest regeneration. Additionally, the Group will undertake similar erosion-control projects in Rapentosa – Marathon, affected by the summer 2024 fires, by 2025.

Implementation of anti-erosion projects in areas affected by severe wildfires in Western and Eastern Attica.

Green Interventions: Enhancing biodiversity in two parks

As an active member of the local communities within its operational scope, and with a steadfast commitment to sustainable development, HELLENiQ ENERGY expanded its initiatives in 2024 to inform and raise awareness among the student community on biodiversity. In June 2024, in commemoration of World Environment Day, HELLENiQ ENERGY implemented a series of educational activities in neighboring municipalities, alongside voluntary actions and interventions in the Municipality of Megara, Thriasio Pedio, and the Municipality of Delta in West Thessaloniki. These efforts were designed to enhance the microclimate and biodiversity within the urban environment of the areas in which it operates. Specifically, with the support of the Ministry of Education, Religious Affairs and Sports, in collaboration with neighboring municipalities, the Holy Metropolis of Neapoli & Stavroupoli, the organization “AGONI GRAMMI GONIMI,” as well as environmental organizations “The Bee Camp” and “Echedorou Physis,” more than 1,100 primary school students from neighboring municipalities were educated and sensitized on matters related to the protection of ecosystems and biodiversity. Furthermore, the Group implemented a series of environmentally friendly interventions in two parks, encompassing a total area of 2,300 m², in Athens and Thessaloniki: Theognidos Park in Megara and Nea Magnesia Park in the Municipality of Delta.

Contribution to Health

Strengthening public health protection

HELLENiQ ENERGY is committed to public health protection as an integral part of its social responsibility initiatives. From June to December 2024, the Group, through its subsidiary EKO, supplied motor fuels for the vehicles of the Mobile Health Units (KOMY) of the National Public Health Organization (NPHO), which deliver nursing services to vulnerable population groups and during critical public health threats. Notably, since 2020, KOMY vehicles have become essential in safeguarding and promoting public health. Furthermore, at a local level, the Group has consistently supported the General Hospital of Elefsina “Thriasio.” In 2024, it further contributed by providing a prefabricated building to facilitate health services, thereby enhancing the hospital’s operational capabilities.

“Match for life” program by EKO Cyprus

In 2024, EKO Cyprus launched the “Match for Life” campaign to inform, raise awareness, and encourage public participation in enhancing the Karaiskakeio Foundation’s volunteer bone marrow donor registry. As part of this initiative, EKO Cyprus undertook several additional activities, including collecting samples for new volunteer bone marrow donors at 20 of its fuel stations across Cyprus, donating earnings from car washes to support the program, and organizing informational seminars and a campaign to encourage voluntary registration of EKO Cyprus employees nationwide as bone marrow donors. The “Match for Life” campaign culminated in a charity dinner hosted by EKO Cyprus, featuring prominent Greek celebrities. This event aimed to highlight the program’s mission to key social partners, clients, and collaborators of the company. In February 2025, a new donor registered through the “Match for Life” program was identified as compatible with a patient, providing them with a critical opportunity for treatment. Consequently, a young boy now possesses renewed hope for the future.

HELLENiQ ENERGY, demonstrating a commitment to corporate responsibility, actively supports the National Health System and entities dedicated to the preservation of public health.

Contribution to Culture and Sports

The Group has provided support to national and local sports teams and events over the years, thereby contributing to the promotion of fair play. It also participates in cultural activities, aiding in the preservation and dissemination of the country’s cultural heritage.

Gold sponsor of the Hellenic Paralympic Committee

In 2024, HELLENiQ ENERGY, acting as the Grand Sponsor of the Hellenic Paralympic Committee, hosted two distinguished events in Athens and Thessaloniki under the title “Paralympic Panorama,” emphasizing sports, equality, and social inclusion. These events afforded the public the opportunity to observe demonstrations of Paralympic sports by esteemed Greek athletes with disabilities, as well as notable Paralympians. In Thessaloniki, 400 primary school students attended the event, gaining insights into the values of inclusion and diversity. Furthermore, HELLENiQ ENERGY has renewed and upgraded its sponsorship as the Gold Sponsor of the Hellenic Paralympic Committee for the next four years, with the objective of advancing the Paralympic movement in Greece and fostering a more equitable society for all.

Grand sponsor of the EKO Acropolis Rally and the National Basketball Teams

The Group, through its subsidiary EKO, has announced its continuous commitment as the Namesake and Grand Sponsor of the “EKO Acropolis Rally” for the next four years. This announcement was made during an event commemorating the 71st anniversary of this major motor race in Greece. As part of this initiative, the Group donated 11 high-tech defibrillators to the Lamia Hellenic Red Cross Regional Department and supplied motor fuel to 15 Medical Mobile Units and rescue vehicles in Central Greece, Peloponnese, and Attica, where the “EKO Acropolis Rally” is held. Additionally, EKO serves as the Grand Sponsor of all National Basketball Teams and supports the Hellenic Basketball Federation’s “Blue and White Stars” new program, which promotes children’s participation in sports through nationwide basketball tournaments involving over 12,000 children annually from across Greece.

Employees Volunteering

Moreover, in celebration of International Women’s Day, the Group’s employees demonstrated their commitment to social solidarity by actively participating in a voluntary project aimed at enhancing the living conditions of over 660 women and their families. In Athens, Thessaloniki, and Komotini, they supported three centers dedicated to the protection, empowerment, and skill acquisition of vulnerable women. Specifically, in Athens, the “Multiple Social Activities” space and the “Tailoring Workshop” of the Hellenic Red Cross “Social Welfare Sector’s Multipurpose Center” were renovated and equipped through the voluntary efforts of the employees. In Thessaloniki, maintenance and landscaping work was undertaken at the Women’s Center “Iris,” while in Komotini, support was provided to the “Shelter for Abused Women,” which is the only facility of its kind in the Region of East Macedonia – Thrace.

In recognition of World Environment Day, a series of interventions based on environmentally friendly solutions were organized in two parks with a total area of 2,300 m² in Athens and Thessaloniki, at Theognidos Park in Megara and Nea Magnesia Park of the Municipality of Delta. These initiatives included the participation of 150 volunteers and their families from the Group’s facilities in Attica and Thessaloniki.

During the Christmas holidays, voluntary actions were conducted in Thriasio Pedio and West Thessaloniki as part of a program supporting social groceries and soup kitchens in local communities. A total of 51 employees were involved in preparing, cooking, and portioning meals. Additionally, 212 volunteer employees participated in the Christmas initiative by providing gifts to children from vulnerable families and writing well-wishes for the beneficiaries on a designated platform. These messages were printed on Christmas cards and included with care packages.

The Group consistently organises voluntary blood donations to support the blood repository it has established. The total number of volunteer contributors in Greece amounts to 390 individuals. In 2024, they participated in collecting 219 units of blood across four drives. Throughout the year, the demand for 189 blood units was successfully met. HELLENiQ ENERGY incentivizes and recognizes donors by awarding an additional day of leave for each donation. A total of 164 people benefited from this initiative.

Actions in the Countries where the Group Operates Internationally

The Group also undertakes corporate responsibility actions in countries such as Bulgaria, the Republic of North Macedonia, Cyprus, Montenegro, and Serbia, where it operates internationally. This demonstrates the Group’s efforts to create value in each country where it has operations.

Indicatively, EKO Cyprus has announced its collaboration with the Cyprus Fire Service to provide practical solutions for citizens, society and the protection of human life, nature and property. This initiative involved the procurement of two complete sets of equipment, comprising six rescue tools, to serve two cities, with the ultimate aim of acquiring five sets to cover all cities in Cyprus. Moreover, EKO Cyprus supplied an inflatable rescue boat along with essential equipment, including life jackets, helmets, gloves and specialized suits. The company also funded a training program for eight non-commissioned officers at the Fire Service College in the United Kingdom, renowned as the world’s leading institution for the training of firefighters and special rescue units and emergency services.

Consumers and End-Users

The Group’s extensive network of fuel stations and facilities ensures uninterrupted operation, even in remote areas, thereby meeting consumers’ need for reliable energy access. All fuel products supplied by HELLENiQ ENERGY, including liquefied petroleum gas (LPG), gasoline, diesel, kerosene, fuel oil, and bitumen, adhere to the specifications mandated by national and European legislation. The products are available to commercial customers, industry, and resellers, with the Group’s significant storage capacity ensuring fuel supply in the markets where it serves.

The increasing demand for new products and services, such as biofuels and renewable energy sources (RES), underscores the Group’s important role in meeting consumer needs for sustainable energy solutions. HELLENiQ ENERGY continuously monitors developments and actively contributes to promoting sustainable mobility by supporting initiatives that aim to change the technological structure and fuel mix of transport vehicles, facilitating the transition to a low-carbon economy. This approach helps to meet climate change mitigation targets while simultaneously offering opportunities to generate new revenue streams through investments in advanced biofuels and the expansion of the electric vehicle charging infrastructure network.

Through its subsidiary EKO, the Group contributes to the overall reduction of CO2 emissions in the road and air transport sector by offering sustainable fuels such as biodiesel, bioethanol and SAF (Sustainable Aviation Fuel) in commercial fuel blends. In addition, electric vehicle (EV) charging services are provided by Elpe Future, a subsidiary of the Group, which, among other services, operates fast EV chargers at EKO and bp stations on motorways.

In addition, the Group has established a process to engage and to provide superior service and responsiveness to consumers and end-users needs and to address material impacts. The call center operates 24/7, serving the consumers and the end-users of our entire network of fuel stations. In 2024 the call center answered 41,692 calls.

The results of surveys measuring customer satisfaction provide valuable insights into the performance of a product, service, or company in relation to the expectations of its customers. For this reason, HELLENiQ ENERGY attaches particular importance to these surveys, as they are crucial for assessing customer satisfaction, understanding their needs, and improving overall experience. With a particular emphasis on providing positive customer experience at fuel stations, HELLENiQ ENERGY, through its subsidiary EKO S.A., has implemented a series of programs and initiatives to provide a positive experience to fuel station customers and better serve their needs.

Each fuel station undergoes evaluation by a covert inspector between four to twelve times annually. In 2024, a total of 4,539 inspections of fuel stations were conducted throughout Greece.

A key element of the Group’s transformation strategy is the Horizon program. As HELLENiQ ENERGY has integrated a variety of business activities, the Horizon program includes the “Digital Retail”, aimed at customers and designed to extend the reach of HELLENiQ ENERGY’s loyalty program throughout Southeast Europe. This element enhances interaction and transparency with retail consumers, adopting a coherent approach towards partners and corporate customers. In this way, the experience and relationship in the retail sector are improved, creating commercial value for both the Group and its consumers.

Product quality assurance is achieved through continuous quality controls throughout the year, at all stages of the supply chain, from the refinery to the point of sale. The Group maintains evidence of compliance with defined acceptance criteria for the supply of its products. Products are made available to customers only after verification of compliance through audits at all stages of the supply chain. In 2024, within the territory of Greece, EKO conducted 94,452 qualitative analyses on 7,746 fuel samples from fuel stations. Moreover, 7,173 aviation fuel analyses and 27,429 lubricant analyses were carried out at EKO’s Chemical Laboratory.

The fuel station personnel undergo extensive training in customer service and sales promotion to prevent any adverse effects on consumers and end-users.

In 2024, training programs were conducted within the partner networks KALYPSO KEA S.A. and EKO S.A., involving fuel station managers, owners, and staff. The training modules included topics such as EKO-Castrol Lubricants, Customer Service and Sales Promotion, and Heating Diesel Distribution. In 2024, a total of 4,345 individuals received both theoretical and practical training, amounting to 10,158 hours of training in Greece.

Corporate Governance

The institutional framework governing the Company’s operation and obligations is L. 4548/2018 on the reform of the law of sociétés anonymes and L. 4706/2020 on corporate governance. The Company’s Articles of Association can be assessed through the Company’s website under the section titled Articles of Association.

As a listed company on the Athens Exchange, the Company has additional responsibilities in respect of the individual sections of governance, the dissemination of information to investors and supervisory authorities, and the publication of financial statements, among other obligations. The principal laws describing and imposing the additional obligations are L. 4706/2020 and the Hellenic Capital Market Commission decisions and circulars issued by delegated authority of the law (decisions no. 1Α/980/18.09.2020, 1/891/30.09.2020 as amended and in force, 2/905/03.03.2021, circular 60/18.09.2020), L. 3556/2007, L. 4374/2016, the ATHEX Exchange Rulebook, the provisions of article 44 of L. 4449/2017 (Audit Committee), as amended and in force, in conjunction with the caveats, clarifications and recommendations of the Hellenic Capital Market Commission (indicatively, documents no. 1149/17.05.2021, 425/21.02.2022 and 784/20.03.2023), as well as decision no. 5/204/14.11.2000 of the BoD of the Hellenic Capital Market Commission, as in force.

1. Corporate Governance Code

The Company has adopted the Hellenic Corporate Governance Code (June 2021 edition) of the Hellenic Corporate Governance Council (HCGC) (hereinafter referred to as the “Code”). This Code is accessible on the HCGC’s official website at the following e-address: https://www.esed.org.gr/en/code-listed. In addition to being available on the HCGC’s website, the Code is also accessible on HELLENiQ ENERGY’s website.

During 2024, the Company complied with the provisions of the above Code, with the deviations stated below in section 2.

The Company monitors the developments in the current regulatory framework as well as the best practices in corporate governance so as to ensure not only compliance with the regulatory framework but also to formulate policies, values, and principles that govern its operation while ensuring transparency and safeguarding the interests of its shareholders and all stakeholders.

During 2024, the Company proceeded to revise/ update:

- the Audit Committee’s Operation Regulation

- the Nomination Committee Operation Regulation

- the Board of Directors Operation Regulation, as well as the policies relating to corporate governance and, in particular:

✓ the Suitability Policy and,

✓ the BoD Members’ Remuneration Policy aiming at rendering them more aligned with the latest optimal corporate governance practices.

2. Deviations from the Corporate Governance Code

| Hellenic Corporate Governance Code | Explanation/Reasoning for deviating from the special practices of the Hellenic Corporate Governance Code |

|---|---|

|

Succession of the BoD Gradual replacement of the members of the Board of Directors (Special Practice 2.3.2) | The practice followed by the General Meeting of the shareholders is that the term of office of the members of the Board of Directors begins and ends at the same time. This practice has been successfully implemented, without raising an issue of lack of administration. |

|

BoD members’ remuneration Recovery of variable parts of executive BoD members’ remuneration (Special Practice 2.4.14) | The existing remuneration system for executive BoD members does not include provisions for the possibility of refunding part or the whole of the executive BoD members’ variable remuneration, as this would amount to a discrimination at their expense compared to Company executives with the same grade. The Company also deems that such a clause is not necessary, as the relevant remuneration is paid following an individual assessment of each executive member’s performance and under no circumstances can they exceed the predetermined maximum limits on their annual ordinary remuneration. |

|

BoD Evaluation (Special Practices 3.3.3 & 3.3.4) | Given that the present BoD was elected in June 2024, no assessment of its effectiveness (collective or individual) has been performed to date. The BoD’s Evaluation Policy and Procedure and its Operation Regulation that the Company has adopted, provide for an assessment of the effectiveness of the BoD (as collective body), its committees and individual members on an annual basis, while same assessment is provided to be performed by an external consultant every three years. The last evaluation process was concluded in April 2023 with the support of KPMG. The next evaluation of the BoD and of its Committees is expected to take place in the first semester of 2025, upon completion of the present BoD’s first year in office. |

3. Other Corporate Governance Practices

In the context of implementing a structured and adequate corporate governance system, the Company has implemented specific good corporate governance practices, some of which are over and above those provided by the applicable legislation and relate to the BoD’s duties and its operation in general (a detailed reference to the BoD Committees follows in section 7):

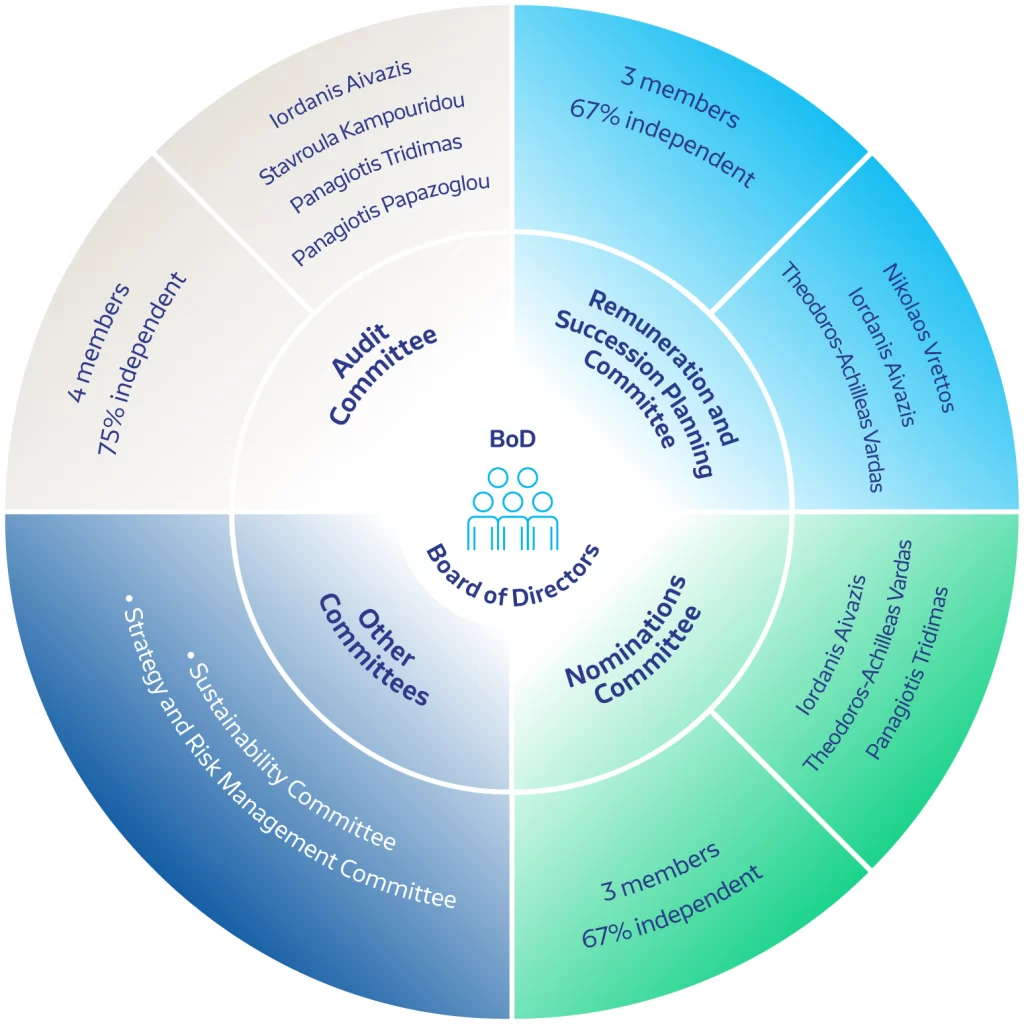

- Due the Company’s nature and purpose, the complexity of issues and the necessary support of the Group, which includes a number of operations and subsidiaries in Greece and abroad, and in order to be assisted in its work, the BoD has established committees, comprised of members thereof, with advisory, supervisory or/and approving authorities. These committees are outlined below (a detailed reference to such shall be made at the section 7, under paragraph “Other BoD Committees”):

i. Strategy and Risk Management Committee

ii. Sustainability Committee

- In addition to the above BoD committees, committees with an advisory and coordinating role have been established and operate in the Company. They comprise of senior executives of the Company and their objective is to support the work of the Management. The principal such committees are the following:

i. Executive Committee

ii. Group Credit Committee

iii. Investment Evaluation Committee

- The Company has adopted corporate governance policies and procedures, which include:

- The Procedure for handling inside information and properly informing the public, in accordance with the provisions of Regulation (EU)) 596/2014, which includes the appropriate mechanisms and methodologies for the assessment of information so that it may qualify as “inside”, the prohibition of abusing or attempting to abuse inside information or recommending to another person to proceed to an abuse of inside information, as well as the prohibition of unlawful disclosure.

- The Procedure for the compliance of persons discharging managerial responsibilities, in accordance with the provisions of article 19 of Regulation (EU) 596/2014, which includes a clear and detailed recording of the requisite notification actions, aiming at strengthening transparency regarding the transactions of management officers and of the persons closely associated therewith and identifying potential risks (abuse, market manipulation, etc.).

- The Policy and Procedure on related party transactions, which sets out the mechanisms for identifying, supervising and approving the transactions in question. In the context of the procedure relevant documents and information concerning related parties are kept and updated. The information on the above transactions among associate companies are included in the report accompanying the Company’s financial statements, in order to be disclosed to the shareholders. According to the provisions of L. 4548/2018 (article 99- 101), Company transactions of any kind with parties related to it, are permissible only following approval by the BoD or the General Meeting, as per case, unless they fall under the exceptions stated in the law.

- The Policy and Procedure for preventing and managing conflict of interest situations, which provides for designating the way in which conflict of interest may arise, for receiving reports or clarifying doubts in cases of such (actual or potential) conflict and for taking appropriate measures for managing them.

4. Main Features of the Systems of Internal Controls and Risk Management in Relation to the Financial Reporting Process

The Group System of Internal Controls and Risk Management in relation to the financial statements’ and financial reports’ preparation process includes controls and audit mechanisms at different levels within the Organization, which are described below:

a) Group level controls

Risk identification, assessment, measurement and management

The prevention and management of risks forms a core part of the Group’s strategy. The scope, size and complexity of the Group’s activities require a composite system of methodical approach and treatment of risks, which is applied by all Group companies.

The identification and assessment of risks is carried out mainly during the strategic planning and the business plan preparation phase. The benefits and opportunities are examined both in the context of the Company’s operations, but also in relation to the several different stakeholders who may be affected.

The risks examined include a) operational, b) financial and c) strategic risks, as well as d) regulatory compliance and supervision risks. More specifically and indicatively, issues that are examined include the effect of operational availability of units, supply chain, human resources, technological developments, taxation, interest rates, commodity prices, exchange rates, among others. Additionally, issues pertaining to health, safety, environmental, corporate governance and regulatory compliance risks are thoroughly evaluated. Furthermore, risks associated with the business model and strategy, as well as market trends, including competition, geopolitical developments, regulatory changes are accessed.

Planning and monitoring / Budget

The Company’s progress is monitored through a detailed budget per operating sector and specific market. The budget is adjusted at regular intervals to consider the changes in the development of the Group’s financials that depend greatly on external factors, including the international refining environment, crude oil prices and the euro / dollar exchange rate. Management monitors the Group’s financial results through regular reporting, comparisons vs the budget, as well as through Management Team meetings.

Adequacy of the Internal Control System

The Internal Control System (ICS) encompasses the policies, procedures and tasks that have been designed and implemented by the Group’s Management to facilitate the effective management of risks, the achievement of corporate objectives, the assurance of the reliability of financial and managerial information, and compliance with laws and regulations.

The independent Group Internal Audit General Division (GIAGD), by conducting periodic assessments, ensures that the risk identification and management procedures employed by the Management are sufficient, that the ICS operates effectively and that the information provided to the BoD regarding the ICS, is reliable and of good quality.

The Internal Audit General Division formulates both a short-term (annual) Audit Plan and a rolling long-term (three-year) Audit Plan, based on ad-hoc risk assessment, as well as additional issues identified by the Audit Committee and Management in previous audit reports. The Audit Committee serves as the supervisory body of the Internal Audit General Division.

The Internal Audit General Division submits quarterly reports to the Audit Committee to facilitate systematic monitoring of the adequacy of the Internal Audit System.

The reports of the Management and the Internal Audit General Division provide an assessment of significant risks and the effectiveness of the Internal Audit System in managing these risks. Through these reports, any identified weaknesses, their actual or potential impacts, and the corrective actions undertaken by Management are communicated. The results of the audits and the monitoring of the implementation of the agreed- upon improvement actions are integrated in the Company’s Risk Management System.

To ensure the independence of the statutory Audit of the Group’s financial statements, the BoD follows a specific policy in order to formulate a recommendation to the General Meeting regarding the election of an External Auditor. Indicatively, this policy provides, inter alia, for the selection of the same audit firm for the entire Group, encompassing the auditing of the consolidated financial statements and tax compliance reports. Furthermore, a certified auditor from an internationally recognized firm is appointed, with strict measures in place to safeguard his or her independence.

Compliance Service

The Compliance Office is responsible for monitoring the Group’s Compliance Risk and constitutes a component of the Internal Control System (ICS). It reports at an operational level to the Audit Committee and at an administrative level to the Director of Monitoring and Risk Management. Through its reports to the Audit Committee, it contributes to the ICS’s improvement and adequacy, as its objective is to ensure that appropriate and updated policies and procedures are set up and implemented, in such a way that the Company’s consistent and comprehensive adherence to the applicable regulatory framework is achieved.

Risk Monitoring and Management Division

The purpose of the Monitoring and Risk Management Division is to centrally monitor and coordinate the management of the Group’s exposure to internal and external risks. The Division was formed in 2024, is independent from executive activities and supports the ICS’s operation by establishing principles, as well as formulating and implementing appropriate and updated policies and procedures governing the identification, assessment, quantification/ measurement, monitoring and management of risks.

Roles and responsibilities of the Board of Directors

The role, powers and relevant responsibilities of the BoD are set out in the Company’s Bylaws (Internal Regulation) that has been approved by the BoD.

Financial fraud prevention and detection

In the context of risk management, areas identified as high risk for financial fraud are monitored through appropriate Control Systems, necessitating the implementation of enhanced controls. Examples include the establishment of comprehensive organizational charts, operational regulations (procurement, investment, oil products’ market, credit, treasury management), as well as detailed procedures and defined approval authority levels. In addition to the internal controls applied by each Division, all Company operations are subject to audits by the Group Internal Audit General Division (GIAGD), with audit findings submitted to the BoD.

Bylaws (Internal Regulation)

The Company’s Bylaws set out, among others, the powers and responsibilities of the principal job positions promoting an adequate separation of powers within the Company. The approved Bylaws have been published on the Company’s website, in accordance with par. 2 of article 14 of L. 4706/2020.